“Only when the tide goes out do you discover who’s been swimming naked” is a quote attributed to Warren Buffett. In it, he quickly captures your attention – and mine.

It’s surely not the way any well-respected money manager or financial advisor wants to be seen. Yet, as we’ve seen in recent headlines, some have gotten caught in the turbulent currents created by the COVID-19 pandemic.

In March, two major index publishers were forced to change their practices to avoid being devastated by hedge funds and others front running the changes in their published holdings. In April, some speculators paid to avoid taking possession of oil futures contracts. Similar to when Lehman Brothers declared bankruptcy in 2008, these events sent shock waves through the investment community.

These shock waves caused me to reconfirm that the approach we take will survive this and future pandemics. We do not want to embarrass any of our clients by swimming naked or doing something else that others find troubling.

The good news is our investment approach passed our most recent review in flying colors.

In fact, I discovered elements that I had not fully appreciated before and even gained a deeper sense of the value of the continuing evolution of Lifetime Capital’s money manager, DFA. We are fortunate to be supported by such a group of extraordinary individuals who work together in a culture steeped in excellence that is committed to pursuing the truth.

To the extent there is bad news, the bad news is that my descriptions of DFA’s approach have failed to keep up with their evolution; somewhat akin to describing a vibrant 3-dimensional high definition video as a black and white pencil sketch.

Unfortunately, my previous efforts at updating these descriptions keep missing the mark. Expanding on details that reveal technical brilliance may help me clarify my understanding, but it does little to show anyone else what it means or how it might make a difference to them.

This morning I decided to start over by stripping away all preconceived notions, even the idea that I would feel embarrassed to be seen swimming naked. Perhaps that random thought occurred because the idea came to me while I was taking a shower.

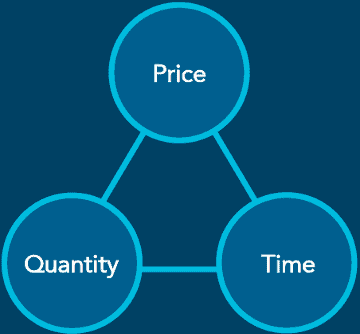

Anyway, what do you know? Eureka! I found it. Or at least I think so. The key difference is the focal point on the Trading Triangle. And guess which one they focus on and which one I don’t?

Spoiler alert! It’s Time! The common belief shared among those who run into trouble is Time or, more specifically, that they are ahead of the competition, have a competitive advantage, and need to move quickly to profit from it. Whether it’s being quick or agile, seeing into the future, or capturing momentum, each and everyone had an unshakable belief that he or she was ahead of the competition and couldn’t miss – until he or she did.

Their focus is on time and acting quickly.

Unfortunately, while this approach works some of the time, studies of investment performance have found that these motivated traders give up so much of their “advantage” to the other traders that they fail to reap sufficient rewards to offset the higher costs incurred.

The initial design of index funds incorporated extraordinary procedures to avoid appearing like motivated traders. And they are effective most of the time. The one notable exception occurs when the index updates the securities listed in the index, known as reconstitution. As reported in March, index publishers feared the time trap caused by reconstitution so much that they suspended the process. Let’s hope the market settles down enough to allow it to proceed soon.

Conversely, the approach employed by Lifetime Capital uses market-based sources for equivalent information and emphasizes patient trading featuring security substitution and low cost (Price and Quantity on the Trading Triangle). It has been much more consistent and successful. I describe it as Investing 3.0 because it builds on the extraordinary procedures developed by the creators of index funds and avoids the time trap of index reconstitution.

In finance, we often refer to Time as being your best friend or your worst enemy. In financial and estate planning, it means having sufficient time for a well-planned strategy using the most effective tools to develop. In savings, it is a combination of accumulated deposits and the power of compound earnings. In investment portfolio management, it describes the trader’s behavior and whether the trader needs to act by making the “bid”. Time is the worst enemy of the “bid” and the best friend of the trader who offered an “ask” and is waiting for the bidder to step across the spread to take it.

Avoiding time traps, whether motivated by idea or deadline, is the key. That’s why successful investing involves (1) STRUCTURE structuring your portfolio around the dimensions of market risks according to the needs of your financial plan and (2) DISCIPLINE cost-effectively maintaining your exposure to those risks.

I hope you find this article helpful and welcome the opportunity to discuss the recent market events or any others of interest or concern to you.

If your investment plan no longer reflects your goals, let us know; we’re here to help you live the life you want to live.

As always, please share this information with someone who might be in need of financial advice and let them know that I will be happy to meet with them and, at no cost or obligation, provide a 2nd opinion about their financial situation.

Stay safe and stay healthy and keep washing your hands,

Rick